What Mr. Market Wants??

By Sakshi Gaurav Jalan | Basant Advisors

Published: Sept 07, 2025

If you’ve ever spent time in the stock market, you know one truth—markets have moods.

One day, they’re cheerful and rewarding; the next, they’re gloomy and ruthless.

Investors often call this the irrational behaviour of markets, but Benjamin Graham—often called the father of value investing—gave this behaviour a face decades ago. He called it “Mr. Market.”

The Idea of Mr. Market

Graham’s “Mr. Market” was imagined as a moody business partner who comes to you every day with buy-and-sell offers at different prices.

Sometimes he’s euphoric, sometimes he’s depressed, and most of the time, he’s simply unpredictable.

For investors, Graham advised ignoring his moods and sticking to long-term fundamentals.

But what about traders?

Investors vs. Traders

Unlike investors who marry their stocks, traders date the market.

They are not just looking at the company’s value ten years from now; they are concerned about what happens in the next hour, day, or month.

For traders, the question becomes far more dynamic:

👉 What does Mr. Market want today?

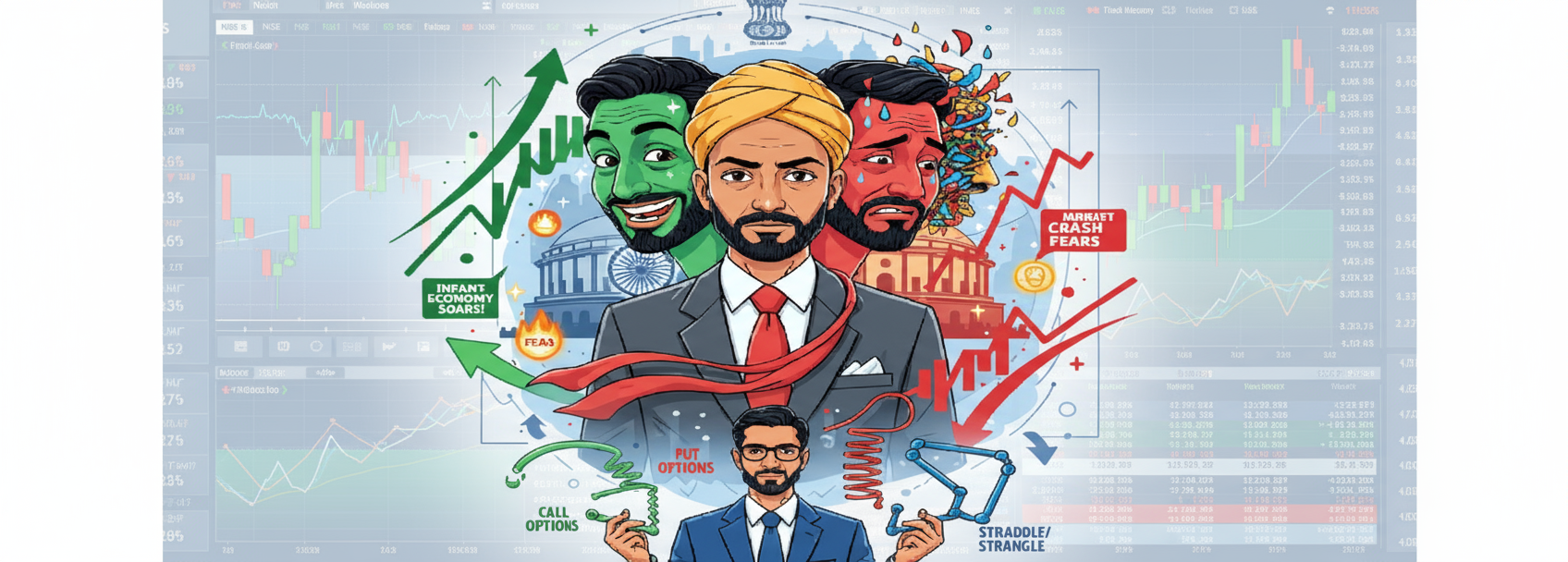

Mr. Market Has Many Moods

Here’s the twist: Mr. Market doesn’t stick to one mood.

-

Some months he rewards momentum traders who ride trends like surfers on a wave.

-

Other times, he favors mean-reversion players who bet on prices snapping back after big moves.

-

On some occasions, he rewards volatility traders when markets swing wildly.

-

At other times, he punishes everyone by going flat and dull.

The mistake most traders make is this:

They find a strategy that works for three months straight and start believing they’ve finally cracked the code. They think they’ve “understood” Mr. Market.

But alas—Mr. Market shows no mercy for this arrogance.

The very next month, the same strategy backfires, and profits vanish.

Options: The Language of Mr. Market

If you want to know what mood Mr. Market is in, there’s one tool that captures it all: Options.

Options are like a mirror of the market’s psychology.

-

If you think Mr. Market wants direction, you can trade calls or puts.

-

If he’s hinting at volatility, straddles or strangles may work.

-

If time decay is the game, theta-selling strategies step in.

-

If momentum is strong, spreads and breakouts can capture it.

In other words, whatever Mr. Market wants, options give traders the flexibility to respond.

They’re like a universal language that translates his mood swings into actionable strategies.

Why Mr. Market Behaves the Way He Does

Mr. Market’s moods aren’t random. They’re shaped by countless forces:

-

Fundamentals like earnings and economic data

-

Technicals like chart patterns and indicators

-

Political developments and global events

-

Institutional flows (what FIIs and DIIs are doing)

-

Fear and greed of retail investors

-

And sometimes—factors nobody can predict

Think of it like the weather.

You can study forecasts, but storms can still appear out of nowhere. That’s why no single strategy works forever.

The true trader isn’t married to one style; he adapts to what Mr. Market wants right now.

The Trader’s Mindset

A successful trader looks at Mr. Market as a dance partner, not an opponent.

You don’t force him to dance your way; you follow his rhythm.

-

If he’s quick, you speed up.

-

If he slows down, you adjust.

The key is flexibility.

The tragedy of most traders is rigidity.

They celebrate a winning streak, assume they’ve mastered the game, and stop listening.

That’s when Mr. Market delivers his harshest lesson:

“You don’t control me—I decide the rules.”

Final Word: Stay Humble, Stay Adaptive

So, what does Mr. Market want?

The truth is, he wants different things at different times.

He rewards those who listen carefully and punishes those who assume too much.

For investors, Graham’s lesson was to ignore Mr. Market’s moods and focus on value.

For traders, the lesson is to observe his moods and align strategies accordingly.

In trading, the winners are not the ones who know everything, but the ones who adapt to anything.

Because at the end of the day, Mr. Market doesn’t care about your strategy.

He only cares about his mood.

And the real question remains:

👉 WHAT MR. MARKET WANTS ??

07 Sep 2025

07 Sep 2025